Contents

There’s safety – and power – in numbers

Senate Releases Draft ACA Replacement Bill

A Conversation with Dave Pearson

Join us for True Grit: Tales of Rural Hospital Success, August 10th 3 pm

Too Good Not to Be True a TORCHCast Webinar Tuesday, August 22nd at 1 pm

There’s safety – and power – in numbers

Working together nets service, innovation and value advantages

By Barry Couch, CIC, ARM

As much as we may wish to forget, we all recall the too-big-to-fail thinking behind government bailouts of large financial organizations and corporations in the wake of the global financial crisis in 2007-2008. Unfortunately, when it comes to the growing crisis of rural and community hospital closures, the general sentiment appears to be the opposite; these hospitals are just too-small-to-succeed.

There is a simple conclusion that can be drawn: when it comes to financial survival, size really does matter. So what’s a small rural or community hospital to do?

Because HealthSure manages the TORCH Insurance Program and the New Mexico Rural Health Network Insurance Program, I can immediately recommend a proven solution; when lots of small community and rural hospitals work together, they enjoy the influence and purchasing power of even the largest provider networks.

Small fish in a big school

Self-serving? Yes, of course… I’m in the risk and insurance business after all. But, there is more here than immediately meets the eye. Beyond the allegorical image of a school of small fish teaming up to enjoy the clout of a big fish, a fundamental economic concept is at work. That concept is value delivery. For simplicity sake, I define value delivery as the ability to do something for someone that they can’t do for themselves.

The primary reason the insurance programs we manage are successful is we deliver value by building things for individual hospitals they cannot build for themselves.

Take for example the outcomes enjoyed by Eastland Memorial Hospital after Mother Nature unleashed hailstorms that twice wiped out its roof. After the second exceptionally large insurance claim to repair the damages, Eastland was faced with the loss of coverage all together.

Here is how Eastland CEO, Ted Matthews described the situation, “When we called them (the insurance company) the second time, I’m sure they were saying, ‘Oh, no! These guys are going to bankrupt us!’”

A considerable amount of time and effort was spent working out a solution. In the end, Eastland Memorial was able to find insurance, from another carrier, for a reasonable cost because HealthSure was able to represent it as part of a much bigger entity; all of the hospitals in the TORCH Insurance Program.

Ted explained it best, “Thanks to being part of the TORCH insurance program, I have property coverage again. If I had to go out single-handedly and find coverage, I honestly do not believe I could have found that coverage.”

What’s important to you?

There are many reasons why participating in something like the TORCH or NMRHN Insurance Programs makes a lot of sense. Chief among them are cost containment, improvement of coverage, elimination of surprises, expert support, collective buying leverage, collaborative leadership with other hospital CEOs, continuous innovation, and more. But, one thing to think about when assessing the relevance and value of these reasons is this: When the TORCH Insurance program began over 10 years ago, these reasons where propositions. They have since been realized. Membership does indeed have its privileges.

In evaluating any value proposal, there are two questions a CEO must ask:

- Do they understand my business?

- Can they convert their understanding into the design of a product or service that creates a specific benefit for my business?

A great example comes from Pat Murray, CEO of Peterson Regional Medical Center who has said the true value his hospital receives from the TORCH Insurance Program, goes far beyond the solutions the program delivers.

While the program provides insurance products for every type of risk a hospital is exposed to, Pat says the desire to nurture deep, long-lasting relationships is what the program is all about.

“Until recently, we had not worked with HealthSure on our health benefit plan. We were only working with them on other types of insurance coverage… general and professional liability. But, as we talked about health insurance, we realized there was an opportunity for savings with respect to our stop loss, our reinsurance.

And, as we explored that and took advantage of the knowledge and familiarity with the broader market the team at HealthSure has, not only did we save there, but they also helped us explore some of our out-of-network costs. As we started peeling back the onion with respect to our health insurance benefits, we realized significant savings by working with providers of out-of-network services.”

The changes to their stop loss reinsurance saved Peterson RMC approximately $25,000. More significantly, by “peeling back the onion” on why, when and how employees access out-of-network services, the hospital has been able to reduce health plan liability by roughly $700,000.

Pat says the TORCH Insurance Program has been successful for Peterson RMC because, “over the course of time, the chief value is the role of sounding board and discussion facilitator played by HealthSure. Instead of just a transactional relationship, there’s an open discussion, and through those discussions, you identify opportunities.”

Look into a bigger mirror

Abiding status quo, remaining on the sidelines and continuing to go it alone may seem expedient in the face of the other challenges small hospitals are currently facing. Maybe so, but if you reflect on how patients behave when it comes to making choices about healthcare, you might see a different picture.

When they have a choice, patients will go to a hospital where a service is provided in volume. (A good example is Lasik eye surgery.) Volume begets expertise, which in turn, instills a sense of confidence and security in people.

In the case of the TORCH Insurance Program, 10 plus years of working and winning side-by-side has led to an intimate understanding of anatomy of the organization and exceptional clarity about the challenges and opportunities each association member faces now and will face in the future.

Success takes time and is not instant. It must be tested, proven and demonstrated. But, thanks to our collective focus, energy and commitment, I believe the momentum of these programs can become self-perpetuating. Instead of facing a future where your hospital may be too-small-to-succeed, take hope as association sponsored programs continue to prove there is strength and power in numbers. And we are just getting started. If you’re in the program, thanks for your loyalty. If you are not, consider what you have to lose…more costs.

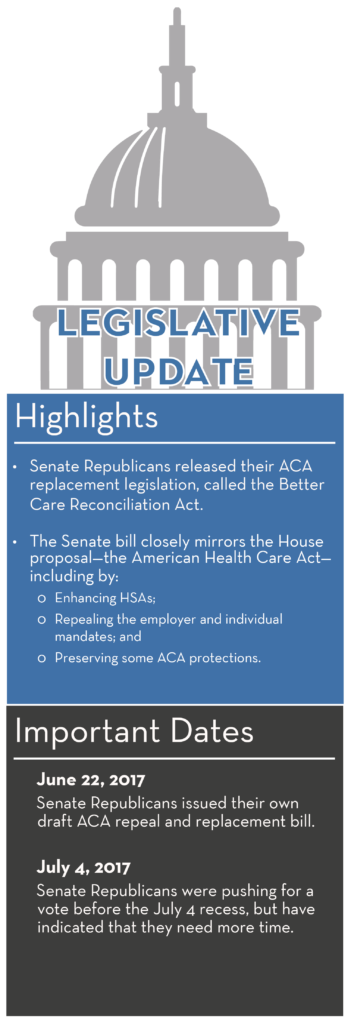

Senate Releases Draft ACA Replacement Bill

Overview

On June 22, 2017, Republicans in the U.S. Senate released a draft of their proposal to repeal and replace the Affordable Care Act (ACA), called the Better Care Reconciliation Act (BCRA). The Senate bill closely mirrors the proposal passed in the House of Representatives—the American Health Care Act (AHCA)—with some differences. For example, unlike the AHCA, the BCRA:

- Would enhance the ACA’s Section 1332 State Innovation Waiver program; and

- Would not allow issuers to impose a surcharge for individuals who do not maintain continuous coverage.

Impact on Employers

The Senate has not voted on any ACA repeal or replacement proposal at this time. The proposal would need a simple majority vote in the Senate to pass. However, amendments may be made before a Senate vote is taken. Republicans were pushing for a vote prior to the Senate’s July 4 recess, but have now indicated that they need more time. If the BCRA passes the Senate, it would need to go back to the House for approval before being signed into law by President Donald Trump.

Legislative Process

On May 4, 2017, the U.S. House of Representatives voted 217-213 to pass the AHCA, which is their proposal to repeal and replace the ACA. As a result, the AHCA moved on to the Senate for consideration. In response, the Senate drafted the BCRA as their own ACA repeal and replacement bill. Because the Senate version differs from the House version, the proposal, if passed by the Senate, would need to be approved by the House before moving on to the president to be signed into law.

Both the House and Senate’s proposed ACA repeal and replacement legislation are budget reconciliation bills, which mean that they can only address ACA provisions that directly relate to budgetary issues—specifically, federal spending and taxation. As a result, these proposals cannot fully repeal the ACA. Budget reconciliation legislation can be passed by both houses with a simple majority vote. However, a full repeal of the ACA must be introduced as a separate bill that would require 60 votes in the Senate to pass.

ACA Provisions Not Impacted

Like the AHCA, the BCRA would not affect the majority of the ACA. For example, the following key ACA provisions would remain in place:

- Cost-sharing limits on essential health benefits (EHBs) for non-grandfathered plans (currently $7,150 for self-only coverage and $14,300 for family coverage)

- Prohibition on lifetime and annual limits for EHBs

- Requirements to cover pre-existing conditions

- Coverage for adult children up to age 26

- Guaranteed availability and renewability of coverage

- Nondiscrimination rules (on the basis of race, nationality, disability, age or sex)

- Prohibition on health status underwriting

Similarly, the requirement to offer the EHB package for individual and small group plans also remains in place. In addition, age rating restrictions would also continue to apply, with the age ratio limit being revised to 5:1 (instead of 3:1), and states would be allowed to set their own limits.

Repealing the Employer and Individual Mandates

The ACA imposes both an employer and individual mandate. Like the AHCA, the BCRA would reduce the penalties imposed under these provisions to zero, effectively repealing both mandates (although they would technically still exist). These changes would apply retroactively for months beginning after Dec. 31, 2015.

The AHCA would have allowed issuers to add a 30 percent late-enrollment surcharge to the premium for applicants that had a lapse in coverage, in an effort to limit adverse selection and encourage individuals to maintain health coverage. However, the BCRA removed this late-enrollment surcharge, so that issuers may not charge higher premiums for individuals who do not maintain continuous coverage.

Note that neither the AHCA nor the BCRA would repeal the ACA’s reporting requirements related to the employer and individual mandates (Section 6055 and Section 6056 reporting).

Replacing Health Insurance Subsidies with Tax Credits

The ACA currently offers federal subsidies in the form of premium tax credits and cost-sharing reductions to certain low-income individuals who purchase coverage through the Exchanges. Like the AHCA, the BCRA would repeal the cost-sharing reductions, effective in 2020. The BCRA would, however, technically leave the premium tax credit provision in place, with heavy amendments taking effect in 2020. These amendments would essentially replace the ACA’s premium tax credits with a portable, monthly tax credit to all individuals that can be used to purchase individual health insurance coverage. The BCRA would:

- Restrict individual eligibility for premium tax credits to those with incomes not exceeding 350 percent of the federal poverty level (reduced from the current eligibility limit of 400 percent);

- Eliminate the cap on repaying Exchange subsidy overpayments; and

- Amend the “applicable percentage” schedule for determining the amount of premium tax credits an individual is eligible for, so that younger individuals would be eligible for higher tax credits.

The BCRA (like the AHCA) would also repeal the ACA’s small business tax credit, beginning in 2020. In addition, between 2018 and 2020, the small business tax credit generally would not be available with respect to a qualified health plan that provides coverage relating to elective abortions.

State Waivers

The AHCA included an option for states to obtain limited waivers from certain ACA standards, in an effort to lower premiums and expand the number of insured. Specifically, states could apply for waivers from the EHB requirement and community rating rules (except strict limitations applied with respect to rating based on gender, age and health status). The BCRA eliminated this state waiver option.

However, the BCRA would provide states additional flexibility to use waivers that currently exist under Section 1332 of the ACA. The ACA’s Section 1332 State Innovation Waivers are intended to allow states to pursue innovative strategies for providing their residents with access to high quality, affordable health insurance while retaining the basic protections of the ACA. Currently, four states have submitted applications for Section 1332 Waivers (Alaska, Hawaii, Vermont and Iowa; California submitted an application, but later withdrew it).

The BCRA would expand the ACA provisions that could be waived under Section 1332, and lower the standards that states must meet in order to be eligible for a Section 1332 Waiver. In addition, the BCRA would also allow the Department of Health and Human Services (HHS) to fast-track waiver applications from states experiencing an urgent or emergency situation with respect to health insurance coverage within the state.

State Stability Fund

The AHCA would have established a Patient and State Stability Fund for 2018 through 2023 to provide funding to states that have applied for, and been granted, a state waiver from the ACA’s community rating rules. Because the state waivers would not be available under the Senate proposal, the BCRA decreases the amount available through this fund, to be used to help address coverage and access disruption.

In addition, the BCRA would establish a second long-term state innovation fund that would dedicate $62 billion over eight years to encourage states to assist high-cost and low-income individuals to purchase health insurance by making it more affordable. In 2018, the BCRA would also provide $2 billion in state grants for substance abuse disorder treatment or recovery support services for individuals with mental health or substance use disorders to address the opioid crisis.

Enhancements to Health Savings Accounts (HSAs)

HSAs are tax-advantaged savings accounts that are tied to a high deductible health plan (HDHP), which can be used to pay for certain medical expenses. To incentivize use of HSAs, the BCRA (like the AHCA) would:

- Increase the maximum HSA contribution limit: The HSA contribution limit for 2017 is $3,400 for self-only coverage and $6,750 for family coverage. Beginning in 2018, the BCRA would allow HSA contributions up to the maximum out-of-pocket limits allowed by law (at least $6,550 for self-only coverage and $13,100 for family coverage).

- Allow both spouses to make catch-up contributions to the same HSA: The BCRA would allow both spouses of a married couple to make catch-up contributions to one HSA, beginning in 2018, if both spouses are eligible for catch-up contributions and either has family coverage.

- Address expenses incurred prior to establishment of an HSA: Under the BCRA, starting in 2018, if an HSA is established within 60 days after an individual’s HDHP coverage begins, the HSA funds would be able to be used to pay for expenses incurred starting on the date the HDHP coverage began.

Relief from ACA Tax Changes

Like the AHCA, the BCRA would provide relief from many of the ACA’s tax provisions. The affected tax provisions include the following:

- Cadillac tax: The ACA imposes a 40 percent excise tax on high cost employer-sponsored health coverage, effective in 2020. Like the AHCA, the BCRA would delay the effective date of the Cadillac tax to 2026.

- Restrictions on using HSAs for over-the-counter (OTC) medications: The ACA prohibits taxpayers from using certain tax-advantaged HSAs to help pay for OTC medications. Like the AHCA, the BCRA would allow these accounts to be used for OTC purchases, beginning in 2017.

- Increased tax on withdrawals from HSAs: Distributions from an HSA (or Archer medical savings account) that are not used for qualified medical expenses are includible in income and are generally subject to an additional tax. The ACA increased the tax rate on these distributions to 20 percent. Like the AHCA, the BCRA would lower the rate to pre-ACA percentages, beginning with distributions in 2017.

- Health flexible spending account (FSA) limit: The ACA limits the amount an individual may contribute to a health FSA to $2,500 (as adjusted each year). Like the AHCA, the BCRA would repeal the limitation on health FSA contributions for taxable years beginning in 2018.

- Additional Medicare tax: The ACA increased the Medicare tax rate for high-income individuals, requiring an additional 0.9 percent of wages, compensation and self-employment income over certain thresholds to be withheld. Like the AHCA, the BCRA would repeal this additional Medicare tax beginning in 2023.

- Deduction limitation for Medicare Part D subsidy: The ACA eliminated the ability for employers receiving the retiree drug subsidy to take a tax deduction on the value of this subsidy. Like the AHCA, the BCRA would repeal this ACA change and reinstate the business-expense deduction for retiree prescription drug costs without reduction by the amount of any federal subsidy, effective in 2017.

Beginning in 2018, both the AHCA and the BCRA would also repeal the medical devices excise tax, the health insurance providers fee and the fee on certain brand pharmaceutical manufacturers. The 10 percent sales tax on indoor tanning services would be repealed effective Oct. 1, 2017, to reflect the quarterly nature of this collected tax. Finally, the BCRA would also reduce the medical expense deduction income threshold to 7.5 percent, beginning in 2017.

Modernize Medicaid

Most of the differences between the AHCA and the BCRA relate to the Medicaid program. Like the AHCA, the BCRA would repeal the ACA’s Medicaid expansion, and make certain other changes aimed at modernizing and strengthening the Medicaid program. For example, the BCRA would provide enhanced federal payments to states that already expanded their Medicaid programs, and then transition Medicaid’s financing to a “per capita allotment” model starting in 2021, where per-enrollee limits would be imposed on federal payments to states. Unlike the AHCA, though, the BCRA would also guarantee coverage for children with medically complex disabilities and ease restrictions on coverage of treatment for mental diseases in psychiatric hospitals.

A Conversation with David Pearson

Rural Health Leadership Radio

In May, Rural Health Leadership Radio had a conversation with TORCH President & CEO, David Pearson. He discussed his leadership role, TORCH’s work to serve Texas’ Rural Hospitals, the ongoing efforts to address the rural healthcare crisis and the wave of rural hospital closures. In addition, he shared some of the TORCH hospitals success stories, and his outlook on the future of rural healthcare.

Join us for True Grit: Tales of Rural Hospital Success

Thursday, August 10th 3 PM

Moderator:

Brant Couch, HealthSure

Panel Members:

Ted Matthews, CEO, Eastland Memorial Hospital

Rebecca McCain, CEO, Electra Memorial Hospital

John Henderson, CEO, Childress Regional Medical Center

Among the defining characteristics successful rural hospitals have in common, true grit and determination tops the list when it comes to survival and success. Walk the line with some of your fellow administrators and see what separates them from the rest. Applying their tactics can put you ahead of the pack.

Join us for Too Good Not to Be True

How maintenance contract logic nets big dollar savings

A TORCHCast Webinar

Tuesday, August 22nd at 1 pm

© babar760 123RF Stock Photo

Attend this webinar before you sign your next equipment maintenance contract. Our panel of experts will teach you how community hospitals:

- Saved over $285,000 in 2016

- Reduce equipment maintenance costs by 18 to 22 percent

- Simplify and improve the management of their vital equipment assets

- Improve the responsiveness and quality of maintenance and repair service

Click here to register today!

Small but important print

This communication is designed to provide a summary of significant developments to our clients. Information presented is based on known provisions. Additional facts and information or future developments may affect the subjects addressed. It is intended to be informational and does not constitute legal advice regarding any specific situation. Plan sponsors should consult and rely on their attorneys for legal advice.

What Happens Next? This ACA Compliance Bulletin is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

©2017 HealthSure. All Rights Reserved.

©2016 Zywave. All Rights Reserved.